Global perspectives. Local expertise.

Featured

Investing Strategies

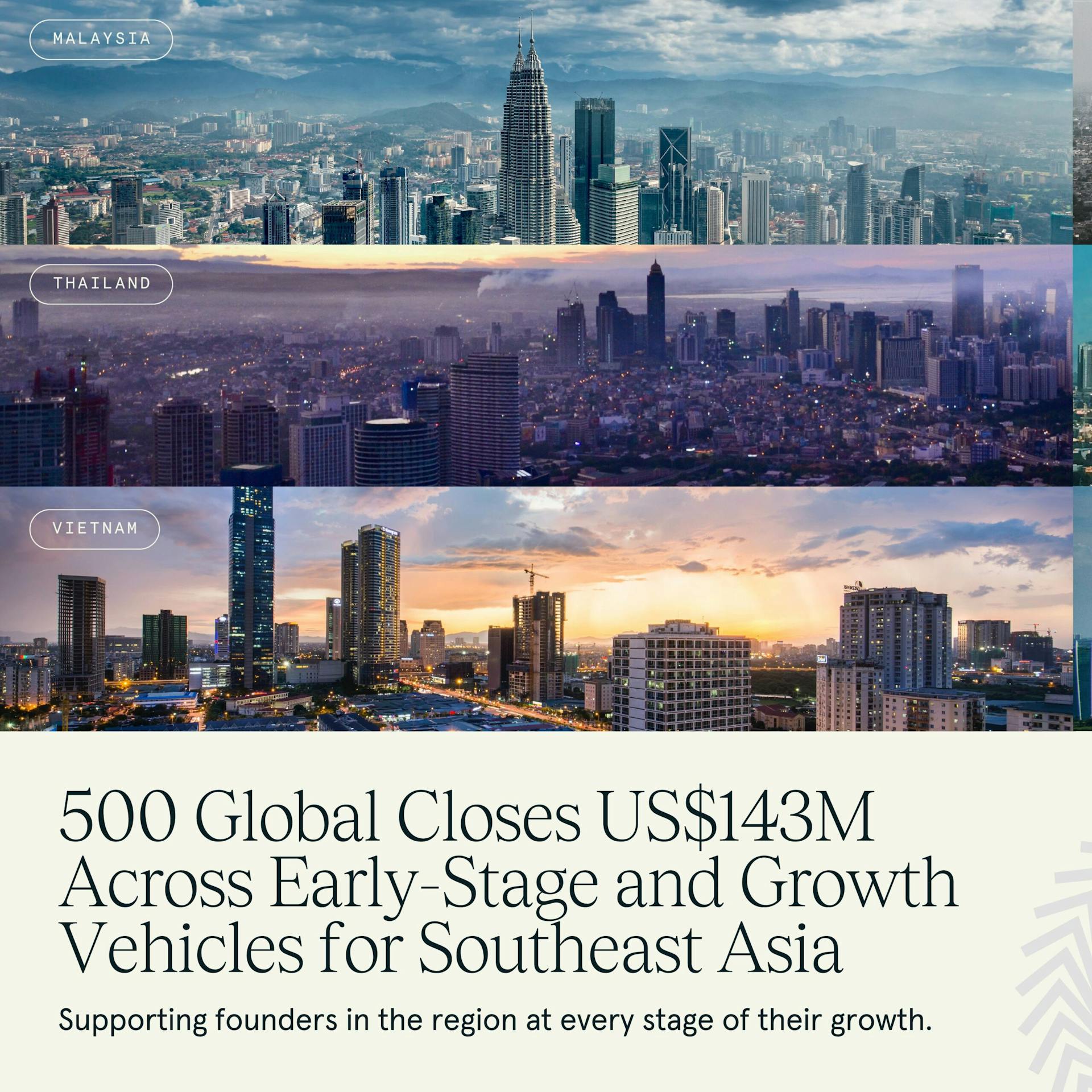

SEE ALL →Promising Regions

SEE ALL →

LATAM: Why a Largely Underpenetrated Market May Be Ready for More VC Growth

With infrastructure in place, Latin America may be primed for a wave of innovation

READ MORE →Emerging Sectors

SEE ALL →Founder Tips

Mental Health Awareness Month: Founders Reflect on their Journeys to Well-Being

BY Nick Bastone

Man standing on a rock in the ocean

READ MORE →Venture Education Resources

SEE ALL →

"Where Everyone Lives and Breaths Innovation" - The Journey to Empowering Immigrant Entrepreneurs

READ MORE →SIGN UP TO STAY UP TO DATE ON GLOBAL INNOVATION