2022.01.14

500 Global Team

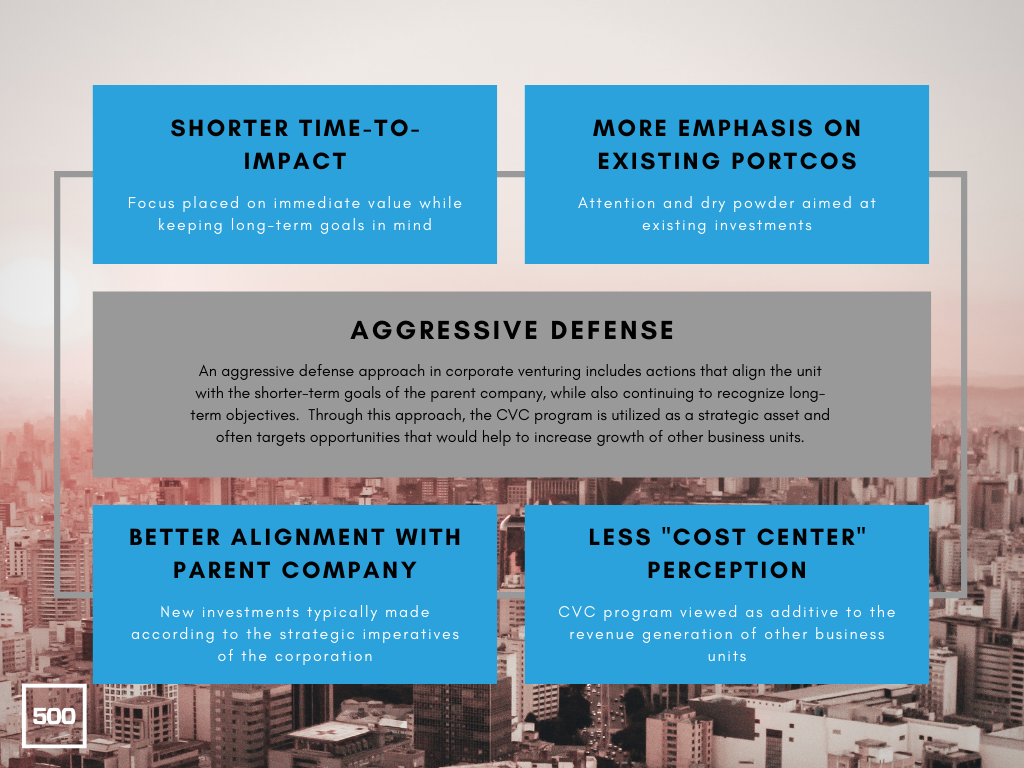

In our previous blog series post regarding cycles of innovation, we discussed two different (and effective!) strategies commonly taken by corporate venture capital (CVC) units during times of economic uncertainty: aggressive defense and aggressive offense. In this blog post we will cover what we believe to be the four most impactful aspects of aggressive defense. In addition, we will offer ways in which CVCs can begin to employ a defensive strategy.

Although both approaches require strategic direction and some level of corporate alignment, a key difference is the timeline for results. Whereas aggressive offense includes actions that take a longer-term view, aggressive defense is typically the preferred strategy when CVCs need a more immediate show of value. Through aggressive defense, the CVC program is utilized as a strategic asset that can help increase the near-term growth and bottom line of other business units.

“Through aggressive defense, the CVC program is utilized as a strategic asset that can help increase the near-term growth and bottom line of other business units.”

- Shorter Time-to-Impact

In times of economic uncertainty, all parts of a corporation, including its venturing and innovation department, need to be providing tangible returns. By shifting their approach to aggressive defense, CVCs place more focus on efforts that can provide quicker instances of value while still keeping long-term goals in mind. This may mean seeking out new investments that would help to enable digital transformation, or conversely, it could mean connecting existing portfolio companies with corporate business units that could benefit from synergies. In both cases, any resulting near-term value can help to provide justification for the corporate venturing activities.

- More Emphasis on Existing Portfolio Companies

In the past, some have described CVCs as “dumb money” that ignored their responsibilities to portfolio companies when times got tough. During the dot com crash, for example, many corporate venturing units abruptly dropped their CVC programs or disregarded their investments. These actions left a negative impression of corporate VC investors that still persist in some circles today. CVC programs employing aggressive defense strategies confront this connotation by doubling down into portfolio support, even during challenging times.

While investors can support their existing portfolio in a variety of ways, communication is likely the most integral. Open lines of communication can help calm worried entrepreneurs and convey a continued commitment to the success of the portfolio. Additionally, proper communication should allow for better insight into the standing of each company, enabling CVCs to coordinate with syndicate partners to increase support for those in need.

Beyond keeping lines of communication open, CVCs should also be diligent in tracking their capital reserves and portfolio company cash positions. In doing so, corporate venturing units should be better prepared for situations where cost reductions or infusions of capital are necessary. Moreover, corporate VC investors may find it helpful to determine which companies are the value-drivers within their portfolios. This action could allow them to allocate more time to the investments likely to produce the most strategic or financial return.

Finally, CVCs are in an advantageous position over their VC peers, in that they are able to provide commercial support by way of their corporate sponsors. To differentiate and access the top deals, traditional financial VCs typically offer “smart money”: capital investment plus the time, advice, knowhow, and networks. Similarly, corporates looking to support their portfolio should aim to supply “smart and strategic capital.” In our 2019 CVC Report, we define smart and strategic capital as bringing capital and scaling capacity in the form of distribution networks, technical and business expertise, R&D co-development, and/or new market access. Through offering smart and strategic capital, corporate venturing units will be able to showcase their impact as investors while likely positively affecting their investments’ bottom lines.

“Corporates looking to support their portfolio should aim to supply “smart and strategic capital.”

- Better alignment with the Parent Company

As briefly discussed in the previous section and our last post regarding cycles of innovation, many corporations infamously cut their CVC programs during the dot com crash of the early 2000s. Most researchers agree that what doomed many programs of the period were their lack of strategic focus and clearly-defined objectives. An approach of aggressive defense acts to combat this dilema by better aligning CVC units with the strategic imperatives of their parent companies. By aligning with the interests of their corporate sponsors, CVCs can work to ensure their efforts will be viewed as additive rather than a form of innovation theater.

While small realignments may be sufficient in some cases, others could require complete program reboots. What if the corporate-level strategy you started with at the beginning of the year no longer matches the current expectations of your CEO? Pick up the phone now! Do not wait three quarters until a big consultancy has figured it out for your board. The CVC unit’s perspective on the future matters at times like this. Now is the time to become indispensable.

“The CVC unit’s perspective on the future matters at times like this. Now is the time to become indispensable.”

As with most other aspects of aggressive defense, communication is again an integral part to promoting alignment with the parent company. In order to encourage better communication, CVCs should look to increase the amount of touch points they have with their corporate stakeholders across the organization. Through these efforts, it is likely a CVC unit could better coordinate its objectives with the current interests of the corporation, especially when these are rapidly changing. Again, we believe that now is the time for a strategy reboot and that means the new technologies, markets, and business models you bet on need to be relevant.

While we are categorizing increased alignment with the parent company as an aspect of aggressive defense, this does not mean CVC units must halt their investing efforts in order to do so effectively. To the contrary, it is possible that better alignment could help to improve the success of corporate VC programs by uncovering areas where corporations are actively seeking external innovation partners. Open Innovation, including CVC, matters more not less during lean times when resources are seemingly scarce.

As mentioned in our last post, Intel Capital utilized an approach of aggressive defense and heavy corporate alignment when helping to promote the adoption of wireless technologies using the 802.11 network standards. As part of this endeavour, Intel Capital launched a $150 million fund in 2002 to invest in companies developing products that would boost the adoption of Wi-Fi networks, ultimately helping to increase the sales of Intel’s new Centrino chip sets. In this case, Intel Capital was able to expand its investing efforts by alignment itself with the broader Intel Corporation.

“Open Innovation, including CVC, matters more not less during lean times when resources are seemingly scarce.”

- Less of a “Cost Center” Perception

As stated in our 2019 CVC Report, an effective CVC unit usually requires significant capital. In our experience, $50 million is the minimum capital necessary to succeed in building a portfolio of bets. However, most funds may be significantly larger, often investing upwards of $100 million per year for added impact. Because of the amount of capital required and the lengthy time-to-impact typical of most corporate venture funds, it is not uncommon for these programs to be viewed as cost centers by other business units. Because most corporations are not accustomed to waiting multi-year periods to see cash flowing from an investment, venture capital is often one of the first areas cut during hard times.

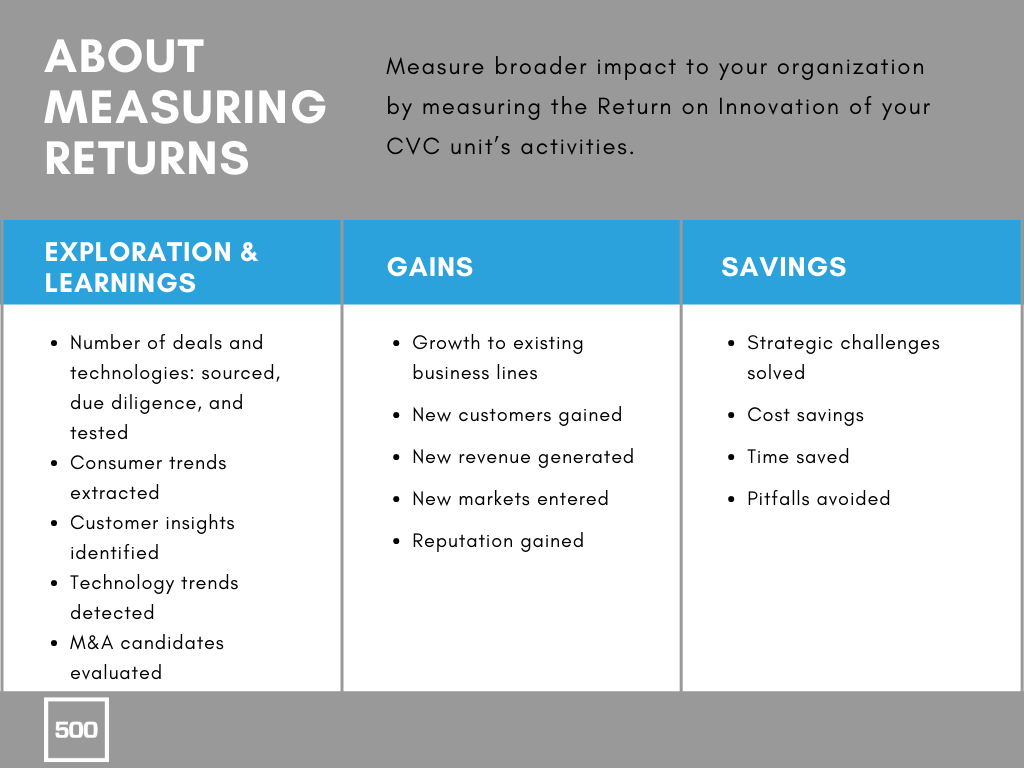

Through the use of an aggressive defense approach, CVC units can begin to shift the cost center association to that of an investment center in the minds of their stakeholders and corporate counterparts. In order to change the perceptions of their broader organizations, CVCs must develop a sustainable approach to measuring returns. For multi-billion dollar corporations, the return on investment of their CVC vehicle—no matter how good its performance is— will most likely not affect the bottom line of the business. Therefore, although possibly harder and more abstract, it is important for companies to measure their “Return on Innovation,” rather than their return on investment. While return on innovation is not always quantifiable, it should give the parent company increased insight into how CVC initiatives have affected revenue and overall growth of other business units. We propose the following quantitative and qualitative parameters as an initial guide to start measuring strategic returns of investment efforts.

“Through the use of an aggressive defense approach, CVC units can begin to shift the cost center association to that of an investment center in the minds of their stakeholders and corporate counterparts.”

Ultimately, an approach of aggressive defense can be used by CVCs to realign with stakeholders and uphold the viability of their corporate venturing activities. This also applies for the majority of CVCs that invest from the balance sheet. In the next post of our series, we will explore the differing approach of aggressive offense and discuss some of its advantages when utilized in corporate VC.

As you read through this and subsequent posts, please let us know here of any questions or comments you might have, and feel free to let us know of additional topics you would like for us to explore. If you would like to share ideas about how you intend to reboot your corporate strategy by placing bets on startups, there is no time like the present.

by Sean Chung and Alba Zurriaga Carda

1.“Venture Capitalist Bill Gurley Warns of Dumb Money – WSJ.” 25 Oct. 2016, https://www.wsj.com/articles/venture-capitalist-bill-gurley-warns-of-dumb-money-1477448558. Accessed 11 May. 2020.2.”The History Of CVC: From Exxon And DuPont To Xerox And ….” https://www.cbinsights.com/research/report/corporate-venture-capital-history/. Accessed 11 May. 2020.

3.”2019 CVC Report – 500 Ecosystems.” https://ecosystems.500.co/resources/2019-cvc-report. Accessed 14 May. 2020.

4.”The History Of CVC: From Exxon And DuPont To Xerox And ….” https://www.cbinsights.com/research/report/corporate-venture-capital-history/. Accessed 12 May. 2020.

5. “Intel Capital, 2005 (A) – Harvard Business Review.” https://hbr.org/product/intel-capital-2005-a/705408-PDF-ENG. Accessed 13 May. 2020.

6.”Unlocking Corporate Venture Capital – 500 Startups.” http://go.500.co/unlocking-corporate-venture-capital. Accessed 20 May. 2020.

7.”Five Things Companies Get Wrong about Corporate Venture ….” 9 Jul. 2019, https://www.bain.com/insights/five-things-companies-get-wrong-about-corporate-venture-capital/. Accessed 13 May. 2020.

8.”Unlocking Corporate Venture Capital – 500 Startups.” http://go.500.co/unlocking-corporate-venture-capital. Accessed 13 May. 2020.

This post is intended solely for general informational or educational purposes only. 500 Startups Management Company, L.L.C. and its affiliates (collectively “500 Startups”) makes no representation as to the accuracy or information in this post and while reasonable steps have been taken to ensure that the information herein is accurate and up-to-date, no liability can be accepted for any error or omissions. All third party links in this post have not been independently verified by 500 Startups and the inclusion of such links should not be interpreted as an endorsement or confirmation of the content within. Under no circumstances should any content in this post be construed as investment, legal, tax or accounting advice by 500 Startups, or an offer to sell or solicitation of interest to purchase any securities. Prospective investors considering an investment into any 500 Startups fund should not consider or construe this content as fund marketing material. Unless otherwise stated in the post, any predictions, forecasts, conclusions, views or opinions expressed represent the current view and thinking of 500 Startups with regard to the subject matter herein based on the sources referenced and internal data and/or analysis which has not been independently verified. 500 Startups does not guarantee any future results for any decisions made based in whole or in part on the content or information contained in this post. The views expressed herein are as at the date of this post and are subject to change without notice.