Many companies and governments in emerging markets still use physical documents, manual signature processes, stamps, and fragmented databases; there’s a need for a better way.

2021.08.06

500 Global Team

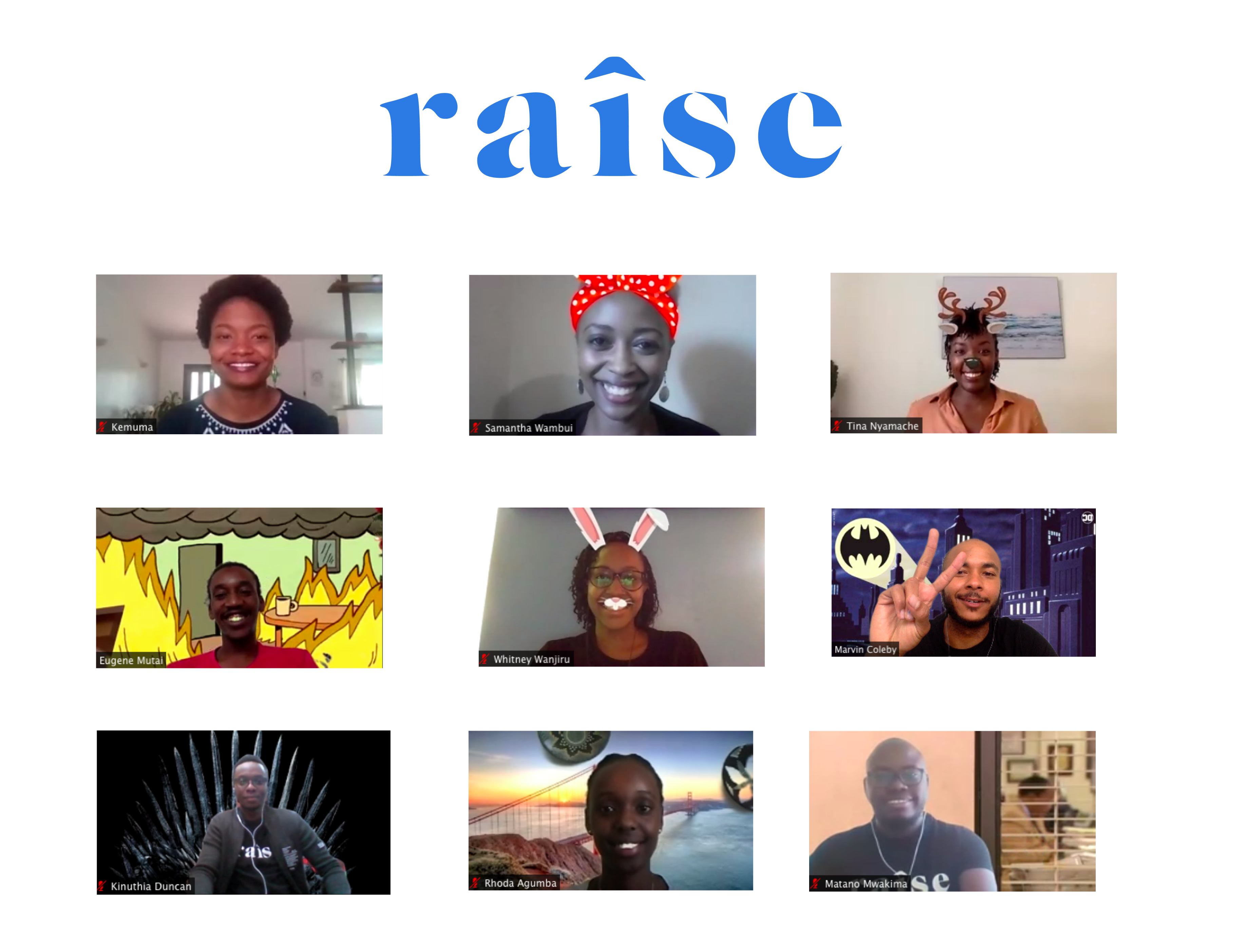

The Raise team. Photo courtesy of Raise

As technology startups emerge around the world, the need for the right tools and infrastructure to support them has likewise grown.

We’re proud to announce our support of Raise which has the potential to become Africa’s cap table solution. Their team offers a unified platform for investors, startups, employees and law firms to manage equity for corporate structures in Africa and abroad, including legal compliance, digital share certificates, and fundraising support.

The Nuts & Bolts

Problem: All companies, no matter where they’re based, need a way to manage their corporate affairs. That includes things like tracking share ownership, issuing and transferring shares, as well as preparing and filing yearly compliance reports. In the U.S. this has gone from manual and expensive work by law firms and banks, to a host of software options such as Carta, Pulley, Shareworks, and Captable.io, among others.

For companies building in Africa, corporate governance and cap table management is much more complex. Even early-stage companies often need to open multiple operating entities across the continent along with a parent company in an investor-friendly jurisdiction such as Delaware, Canada, or Mauritius. We’ve seen this with our own portfolio companies around the continent.

While the pandemic has increased willingness to adopt digital-first practices, many companies and governments in emerging markets still use physical documents, manual signature processes, stamps, and fragmented databases. Add to this mix of admin nightmares additional challenges like issuing stock options to local employees, the difficulty and time for investors to complete due diligence or getting proper regulatory valuations, and it becomes clear there’s a need for a better way. All of these issues combine to raise the transaction costs and time needed to complete investments and proper corporate governance.

Solution: Raise is built with African tech startups in mind from the start, making corporate organization and equity ownership clear and simple for founders building across the continent. Their platform is able to support companies and their subsidiaries in a variety of jurisdictions in Africa as well as holding companies in common foreign jurisdictions, such as Delaware, the EU and Mauritius. With Raise, companies can also manage the entire fundraising cycle on the platform, opening data rooms for investor diligence, modeling fundraise scenarios, and issuing digital certificates and shares at close. Investors and employees benefit as well. By using Raise they can hold and track their equity directly and eventually use the platform to access liquidity.

Getting to Know Raise

The Raise team is building for this space because of their experience with the challenges companies face in trying to manage these matters across Africa. Their subject matter expertise across securities law, fundraising, and compliance comes from working not only with large law firms and venture funds, but with early stage companies as well. We found when talking to the founding team that it is this lived experience of the challenges in the early stages of a company’s lifecycle that really helps them focus on their customers and understand their target market.

Co-founder and CEO Marvin Coleby is a former lawyer with Denton’s, where he specialized in working with venture-backed companies. Joining Marvin is Tina Nyamache, co-founder and head of growth, who previously worked for Village Capital’s Africa Operations, and Eugene Mutai, technical advisor to the team focused on bringing decentralized finance to Africa’s equity.

Why Now?

Even though 2020 was a slightly down year by aggregate amount of venture funding in Africa due to the pandemic, there was still $1.4B raised across 359 rounds, representing a 44% increase in the number of deals, an all time high for one year and 600% increase from just five years ago.

These numbers are just the start. As we’ve seen with markets around the world at 500, there are great founders everywhere. Africa’s technology ecosystem is just scratching the surface and Raise intends to help the new class of founders, employees and investors build it over the next decade and beyond.

Future of Raise

Raise has started with a simple but difficult mission – to build the most efficient platform for private companies across Africa to manage their equity. But they don’t plan to stop there. Once equity ownership is clear, the next step is providing paths to additional investment and liquidity.

As Africa’s fundraising market continues to grow, Raise’s vision is to become the pan-African securities exchange platform, making wealth and investment opportunities potentially available to every investor, founding team and employee through an open financial system for Africa’s digital equities. This will require bridging the gap between fragmented regulations and building relationships with government and regulatory agencies across the continent. The team is up to the challenge, and we’re excited to support them on this mission.

You can learn more about Raise at https://www.getraise.io.

If you would like to learn more about companies, sectors, and trends that we are excited about as well as receive invitations to exclusive previews and expert roundtables, please sign up here.

Legal Disclaimers: 500 Startups programs (including accelerator programs), investor education services, strategic partnership consulting services and events are operated by 500 Startups Incubator, L.L.C. (together with its affiliates, “500 Startups”) and the funds advised by 500 Startups Management Company, L.L.C. do not participate in any revenue generated by these activities. Such programs and services are provided for educational and informational purposes only and under no circumstances should any content provided as part of any such programs, services or events be construed as investment, legal, tax or accounting advice by 500 startups or any of its affiliates.

The views expressed here are those of the individual 500 Startups personnel, or other individuals quoted and are not the views of 500 Startups or its affiliates. Certain information contained herein may have been obtained from third-party sources, including from portfolio companies of funds managed by 500 Startups. While taken from sources believed to be reliable, 500 Startups has not independently verified such information and makes no representations or warranties as to the accuracy of the information in this post or its appropriateness for a given situation. In addition, this content may include third-party advertisements or links; 500 Startups has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, tax or accounting advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation, offer to sell or solicitation to purchase any investment securities, or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by 500 Startups. (An offering to invest in an 500 Startups fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by 500 Startups, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results.

Charts and graphs provided herein are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Unless otherwise expressly stated, figures are based on internal estimates and have not been independently verified. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. All logos and trademarks of third parties referenced herein are the logos and trademarks of their respective owners and any inclusion of such trademarks or logos does not imply or constitute any approval, endorsement or sponsorship of 500 Startups by such owners.

Please see Section 2 of our Terms of Use for additional important information.