In the midst of much uncertainty, our approach provided a useful framework for evaluating opportunities in different sectors.

2021.07.08

Tony Wang

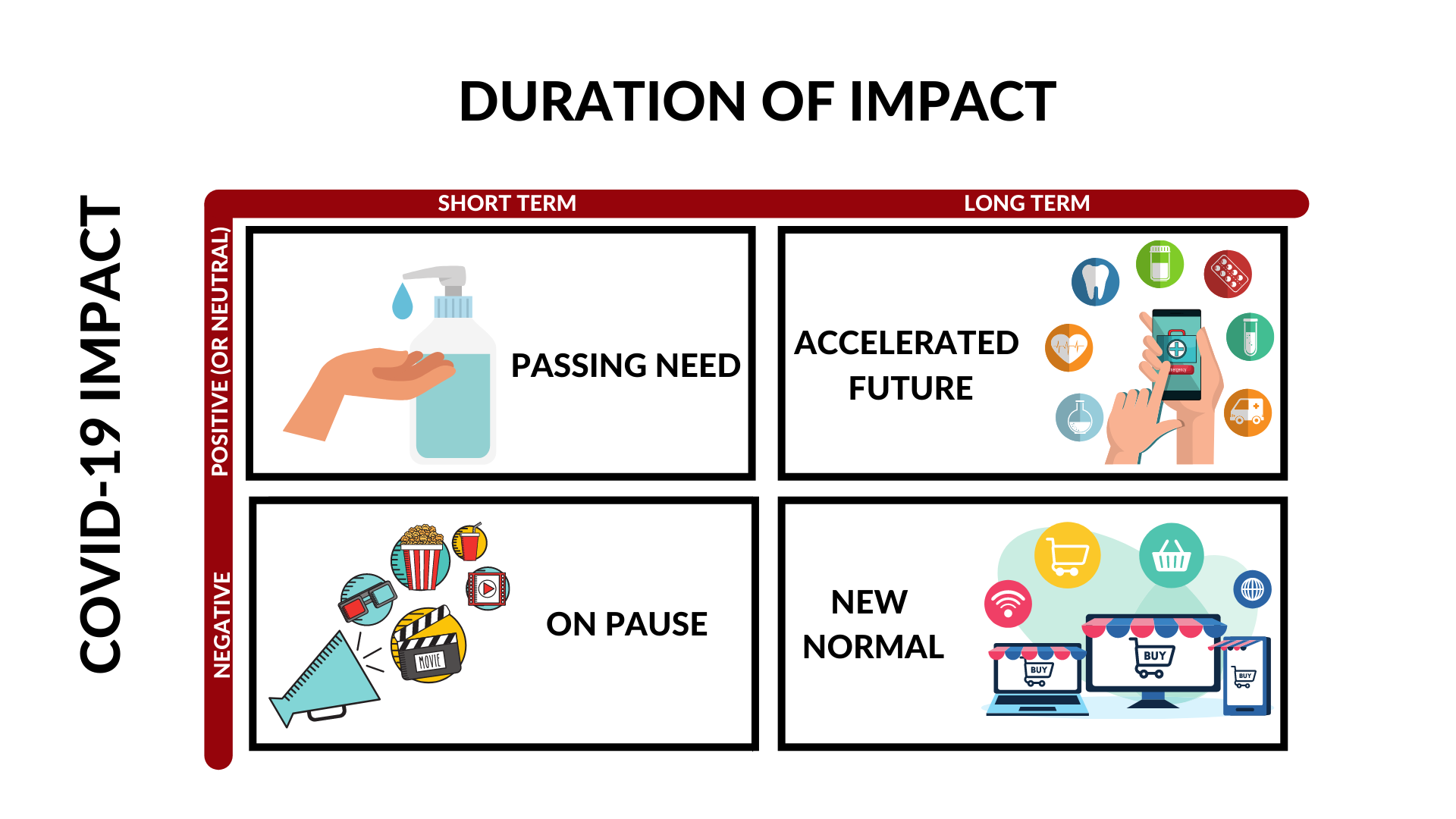

A year ago, we published our post-COVID-19 framework outlining which industries we believed the pandemic would impact and whether the impact would be short-lived or long term. In the midst of much uncertainty, our approach provided a useful framework for evaluating opportunities in different sectors–from drone deliveries to financial tools for gig workers.

While the pandemic harmed many industries such as hospitality and leisure where more than 3 million people lost their jobs, we know that others, including a historically laggard healthcare sector, were propelled forward. For many, technology served as a buoy, and more, as an accelerator.

Thanks to the vaccine rollout, the world is reopening–albeit unevenly. I recently spent time in Taiwan, a country health officials and the press lauded as exemplary just a few months ago for its management of COVID-19. Unfortunately, the virus made a late appearance there recently, as in other parts of Asia, leading to restrictions on social gatherings. India and Brazil experienced recent surges in Covid deaths, and there’s worry about the consequences of a rapidly-spreading Delta variant in the U.S., Australia, the U.K. and elsewhere.

In parts of the world that have reopened, not all is smooth. In the U.S. supply chains are still grappling with a surge in consumer demand, which could lead to a “bullwhip effect,” as reported in the WSJ. A global shortage of computer chips threatens multiple industries, from automakers to kitchen appliances.

At 500, we are adapting our framework to reflect how some industries that benefited from the pandemic initially are now needing to adjust given the recovery, and how others that saw activity grind to a halt are seeing signs of life.

Passing Need

If you live in the U.S., chances are you’re now able to find those once-elusive antibacterial wipes on the supermarket shelves. Hand sanitizers are now among the top four fastest declining U.S. industries by revenue growth in 2021. Hospitals in the country that experienced shortages of PPE and ventilators are in a better position today, and can finally address a backlog of surgeries. Globally though, countries are still experiencing a shortage of medical oxygen.

Will passing needs translate into lasting behaviors? Procter & Gamble and other makers of cleaning supplies are betting that a heightened awareness of hygiene and cleanliness is here to stay. Similarly, more people may opt for a Peloton over a gym membership. It all remains to be seen.

On Pause

After the initial shock of the pandemic forced plenty of industries to pause momentarily, we expected many would eventually return to pre-Covid levels of business (think energy, ride-sharing, professional sports, dentistry, etc). Already, we’re seeing that play out, with some areas experiencing a major uptick in demand, such as elective surgeries.

But as industries unpause, it’s not exactly business as usual, even for those that were ascendant pre-Covid. To make up for steep pandemic losses, some companies are returning with a notably different approach. After years of aggressively pouring money into user acquisition and not turning a profit, sharing economy players are now eying the bottom line differently. The average Uber and Lyft ride costs 40% more than it did a year ago. Same with Airbnb which is ramping up its prices. To be sure, much of the price inflation may be due to supply constraints (e.g. available drivers) which may take some time to address.

Our New Normal

We expected the Covid crisis would hasten the decline of industries already experiencing headwinds—in particular retail, travel and hospitality, and food & beverage. Although many industries from our “old reality” have started returning, the pandemic has already created a “new normal” where many companies will struggle to regain their former levels of business if they fail to innovate.

Take brick and mortar retail. As people shopped online like never before last year, the pandemic heightened the gloomy outlook for many retail players. A record 12,200 stores closed in the U.S. last year, with about a third of department stores, clothing chains and other mall-based properties. By 2026, nearly 80,000 retail stores are expected to shut across the U.S.

This moment is spurring plenty of evolution, from small businesses turning to Shopify to transition their operations online, to experimenting with pop-up shops that save on overhead, or getting creative like outwear brand Canada Goose, which reimagined its storefronts as museums.

When it comes to travel and hospitality, tourism is returning but the industry is dealing with significant shifts. Although more than half of U.S. consumers report vacation travel plans in 2021, business travel may never fully return as companies embrace video-conferencing. Industry players are finding ways to cater to changing consumer needs by offering creative travel experiences or upping customer service, while embracing solutions such as contactless technologies and putting more emphasis on sanitization.

As reopenings accelerate we’ll be watching those that make the necessary moves to adapt to an altered business landscape.

Accelerated Future

If there ever was a silver lining to the pandemic, it forced industries like healthcare, education, enterprise, entertainment and logistics to fully embrace technology. Telemedicine, which has been around for years but not widely adopted, will become an integral part of healthcare thanks to forced changes in provider practice and reimbursement rates.

Distributed work was already on the rise in some sectors, but the pandemic forced many more companies to consider hybrid models on a long term basis. A PwC survey found that 83% of U.S. employers believe the shift to remote work has been successful and the vast majority are planning investments to support this trend.

A McKinsey survey of global executives found that companies have digitized many activities 20 to 25 times faster than they had previously thought possible, with the pandemic delivering years of change in only a couple months. Another survey of IT leaders revealed that nearly half of respondents reported COVID-19 has permanently accelerated their digital transformation and adoption of emerging technologies such as AI, machine learning, blockchain and automation. As technology investors, we have seen how these trends have accelerated growth in our portfolio companies that are enabling the transformation.

At the same time, the pandemic brought unexpected twists. To the surprise of many, Millennials embraced home ownership, leading to a U.S. housing shortage and opening up opportunities to make real estate more accessible. Or consider the recent surge in retail investing and rising interest in digital currencies (not to mention NFTs). That’s setting the stage for new fintech and crypto innovations on accelerated timelines.

Moving Forward

The pandemic has reset our economy in a way not seen in generations. Even as industries navigate the ongoing impact of COVID-19, the long term influences are beginning to emerge as a new era of innovation growth and adoption unfolds.

2020 validated many early investments we’ve made over the past decade in rising trends such as SaaS, AI, fintech, e-commerce and more. In particular, SaaS companies in our portfolio are enjoying significant momentum, such as Canva, which has recently skyrocketed to a $15 billion valuation. We’re also proud to mention that one of our unicorns, GitLab, was already a notable champion of remote work even before the pandemic.

Looking ahead, a world that is reopening thanks to life-saving vaccines should be an exciting time for a new generation of disruptive companies worldwide. As long-time global investors, we are well positioned to capture the momentum picking up in the New Normal and the Accelerated Future both inside and outside traditional VC hubs.

THE CONTENT IN THIS POST IS PROVIDED FOR GENERAL INFORMATIONAL OR EDUCATIONAL PURPOSES ONLY. 500 STARTUPS MAKES NO REPRESENTATIONS AS TO THE ACCURACY OR INFORMATION CONTAINED HEREIN AND WHILE 500 STARTUPS HAS TAKEN REASONABLE STEPS TO ENSURE THAT THE INFORMATION CONTAINED HEREIN IS ACCURATE AND UP-TO-DATE, NO LIABILITY CAN BE ACCEPTED FOR ANY ERROR OR OMISSIONS. UNLESS OTHERWISE STATED IN THIS POST, ANY PREDICTIONS, FORECASTS, CONCLUSIONS, VIEWS OR OPINIONS EXPRESSED REPRESENT THE CURRENT VIEW AND THINKING OF 500 STARTUPS WITH REGARD TO THE SUBJECT MATTER THEREIN BASED ON INTERNAL DATA AND/OR ANALYSIS WHICH HAS NOT BEEN INDEPENDENTLY VERIFIED, AND WHICH IS SUBJECT TO CHANGE AT ANY TIME.

UNDER NO CIRCUMSTANCES SHOULD ANY OF THE ABOVE CONTENT BE CONSTRUED AS LEGAL, TAX OR INVESTMENT ADVICE FROM 500 STARTUPS OR ANY OF ITS AFFILIATES. 500 STARTUPS DOES NOT GUARANTEE ANY FUTURE RESULTS FOR ANY DECISIONS MADE BASED IN WHOLE OR IN PART ON THE CONTENT OR INFORMATION CONTAINED HEREIN. ALL READERS OF THIS POST SHOULD CONSULT WITH THEIR OWN COUNSEL, ACCOUNTANT OR OTHER PROFESSIONAL ADVISORS BEFORE TAKING ANY ACTION IN CONNECTION WITH THIS POST.

UNDER NO CIRCUMSTANCES SHOULD ANY INFORMATION OR CONTENT IN THIS POST, BE CONSIDERED AS AN OFFER TO SELL OR SOLICITATION OF INTEREST TO PURCHASE ANY SECURITIES ADVISED BY 500 STARTUPS OR ANY OF ITS AFFILIATES OR REPRESENTATIVES. FURTHER, NO CONTENT OR INFORMATION CONTAINED IN THIS POST IS OR IS INTENDED AS AN OFFER TO PROVIDE ANY INVESTMENT ADVISORY SERVICE OR FINANCIAL ADVICE BY 500 STARTUPS. UNDER NO CIRCUMSTANCES SHOULD ANYTHING HEREIN BE CONSTRUED AS FUND MARKETING MATERIALS BY PROSPECTIVE INVESTORS CONSIDERING AN INVESTMENT INTO ANY 500 STARTUPS INVESTMENT FUND. UNDER NO CIRCUMSTANCES SHOULD ANY CONTENT BE INTERPRETED AS TESTIMONIALS OR ENDORSEMENT OF THE INVESTMENT PERFORMANCE OF ANY 500 STARTUPS FUND BY A PROSPECTIVE INVESTOR CONSIDERING AN INVESTMENT INTO ANY 500 STARTUPS FUND.