2018.06.12

Enis Hulli

Turkey, once the leading startup ecosystem in the region with its vibrant local market, now seems to lag behind newcomers like Slovenia, Greece, Romania and the UAE. Overlooked and buried under the macro trends, the Turkish ecosystem is in the midst of a transition and about to make a tremendous leap forward.

Political challenges and a turbulent local market pushed a new generation of entrepreneurs to pursue their passions globally and create market-independent businesses following a model similar to Israel, Estonia or Sweden. These third wave entrepreneurs are now re-building the ecosystem from the ground up.

Early signs of entrepreneurial success and market readiness

The first wave of internet entrepreneurs in Turkey started at the end of the 1990s and turned into the nation’s first success stories like Yemeksepeti (online food ordering startup acquired for $589M), Gittigidiyor (e-shopping marketplace acquired by eBay for $217M) and Pozitron (mobile enterprise development company acquired for $100M).

Meanwhile, other giants like Hepsiburada (e-commerce), Sahibinden (classifieds), Kariyer (job posting) and mynet (internet portal) emerged, showing the country’s strength in internet entrepreneurship and consumer readiness.

“Turkey is the next developing hotspot for technology startups.” (2011) – Matt Marshall, VentureBeat

Capital follows the rising potential

As the first wave companies were gaining momentum around a decade ago, venture capital was still a nascent field in Turkey. Looking for diamonds in the rough abroad, global investors, like General Atlantic, Abraaj and Intel Capital jumped on board with investments in Yemeksepeti, Hepsiburada and Grupanya.

After years of neglecting the region, Western investors were now in a gold rush in Turkey and DFJ, Atomico, and Sequoia all tried to build a physical presence in the country while Rocket Internet decided to replicate its clone factory, aggressively growing to 400+ employees in months.

The second wave of startups emerged post 2008. Also e-commerce heavy, these ventures successfully brought other globally known investors as Earlybird, Hummingbird, Tiger, Kleiner Perkins, Naspers and Amazon to buy stakes in Trendyol (flash sales), Markafoni (private shopping), Ciceksepeti (flower ordering) and Peak Games (social gaming).

“If there’s one thing I keep hearing over and over when it comes to the European startup scene, it’s that investors who are not seriously looking at the Turkish market may be missing out on some of the continent’s biggest digital companies in the next 10 years. — Robin Wauters, Techcrunch (2011)

If Turkish startups can drive meaningful value, so can Turkish funds

First and second-wave entrepreneurs, mostly funded by external sources, beat their international competitors in Turkey, proving their edge in the local market. Local investors, having already missed out on great opportunities, capitalized and launched domestic funds on the lookout for the nation’s next home run success.

Earlybird ($150M), Hummingbird and 3TS established funds dedicated to Turkey while 212 ($30M) and Revo ($65M) also raised capital targeting domestic entrepreneurs. Turkey’s first super angel, Aslanoba, invested $60M in startups in just a couple of years and Galata Business Angels was launched as the first angel network.

DFIs (Development Finance Institutions) played an essential role in reshaping the venture funding scene, financing entrepreneurs and spurring innovation in Turkey. EIF (European Investment Fund), EBRD (European Bank for Reconstruction and Development) and IFC (International Finance Corporation) supported the establishment of new local funds, most recently investing in DCP and ACT, together with the Scientific and Technological Research Council of Turkey (TUBITAK).

Internal and external challenges dishearten foreign investors

The Turkish ecosystem hit its peak in 2012, with $80M invested in local startups, during a time when the country’s economy was flourishing on every level. Since then, political and economic struggles pushed foreign capital out and funding hasn’t reached the 2012 level ever since.

Turkey still has the largest economy in the broader region and the youngest population in Europe, but all the setbacks in recent years demotivated investors. Once a tantalizing market for VCs, Turkey is now a vastly underserved landscape that still provides great opportunities for investors at every stage.

New age entrepreneurs create market-independent businesses

As more money was poured in, public attention rose and put startups at the top of the agenda for many organizations as the entrepreneurial scene in Turkey made a tremendous leap forward. A new breed of entrepreneurs, who learned by doing at first wave startups, emerged to create global-facing businesses, given the negative market outlook in Turkey and serious funding gaps.

Third wave entrepreneurs started to build market independent businesses, like Mobile Action, Koding or Insider, with major international operations and domestic development teams. Leveraging the cheaper available talent in Turkey, Udemy alone was able to raise more capital ($175M) than the whole Turkish ecosystem in the past 3 years ($165M).

Forbes cover star Osman Kibar, founder of the most valuable biotech startup on the planet, is the first Turkish tech billionaire of many more to come…

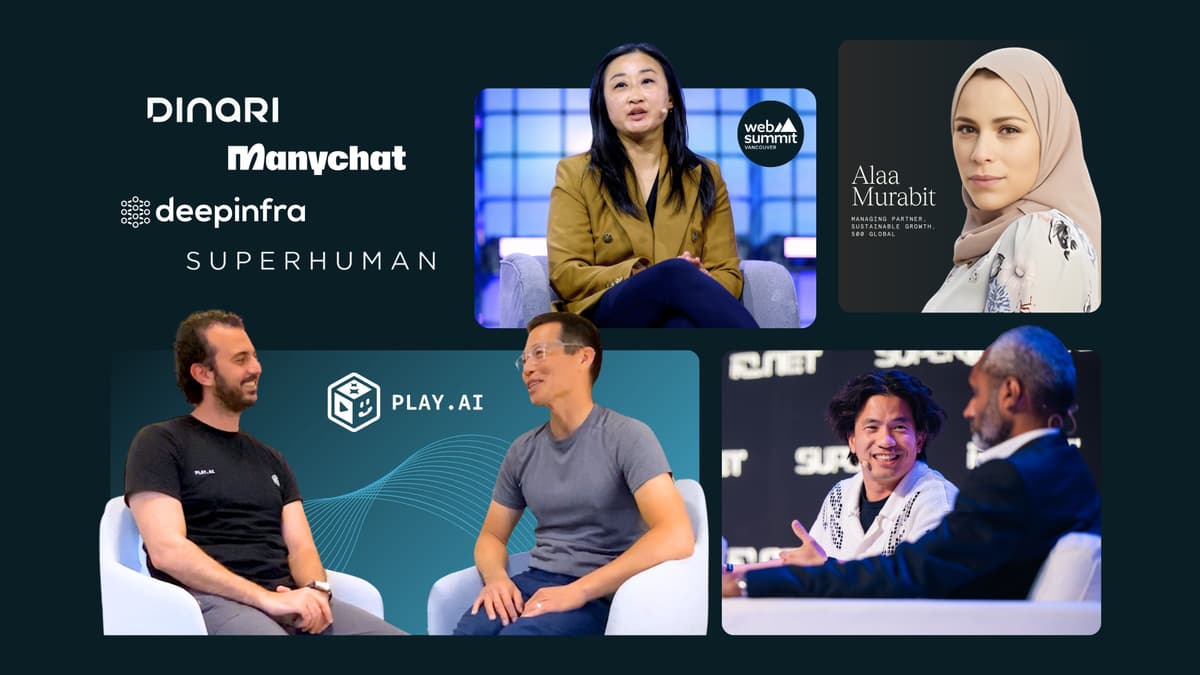

500 Istanbul started in mid-2016 with the belief that global success stories will soon emerge from the region. Our portfolio companies below, accelerate the know-how transfer and pave the way for the next generation

This is just the tip of the iceberg

Insider’s tremendous success and growth in 16 different countries spanning across Eurasia attracted Sequoia’s interest to lead the Series B. The Turkish diaspora continue to surge as Ozzy, Carbon and BillionToOne raised funding from top-tier venture capitalists like Builders, TwoSigma, NFX, Lightspeed, iDrive and Danhua.

Sinemia, the end-to-end movie platform, launched directly in the US market instead of growing regionally and reached multi million dollar ARR in US in less than 6 months. Botanalytics, AppSamurai and FXCubic are all on a similar path with powerful traction from the Western markets since inception.

Yet Turkey is hungry for capital more than ever

The macroeconomic trends that once pulled in capital are gone and the negative climate in the Turkish market has scared out international investors. But it also shifted the entrepreneurial approach and focus to build tech-exporting companies.

Zynga’s $100M acquisition of Peak Games’s casual gaming studio and $250M acquisition of Gram Games are testament to Turkey’s new entrepreneurial identity and a showcase of its dynamic and outlooking culture.

The current lack of funding creates the opportunities that will make the past pale in comparison and risk-averse investors are missing out, big time!