Even in difficult times we see opportunities to build game-changing businesses.

2022.11.10

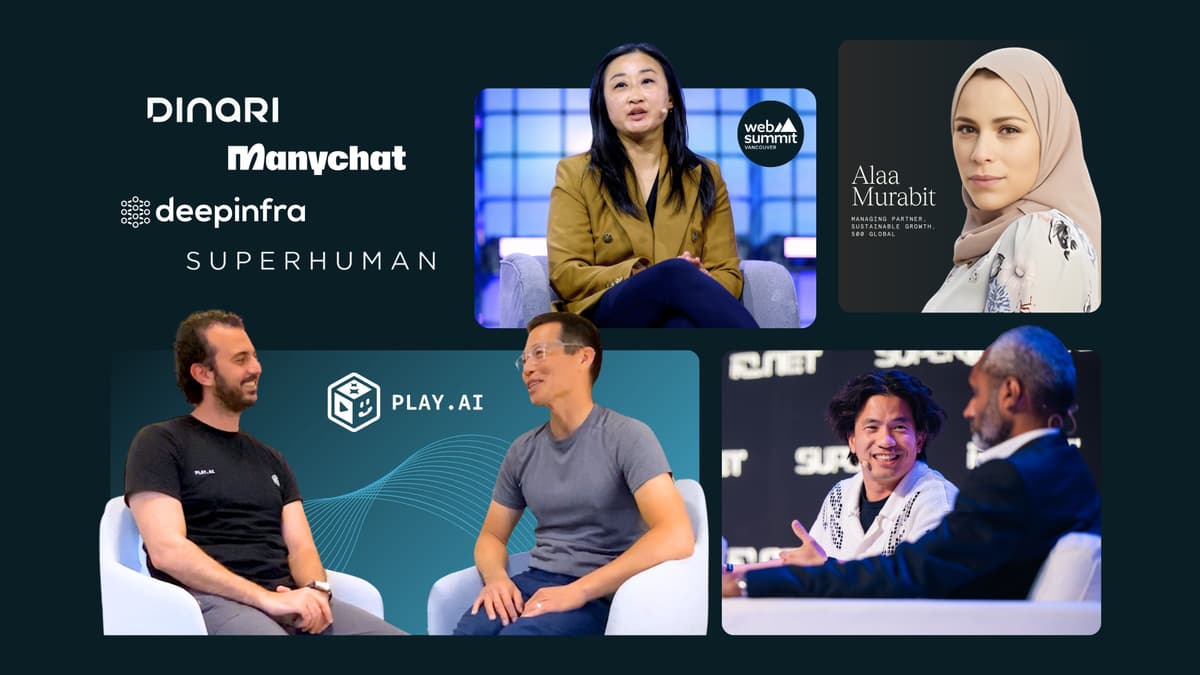

Christine Tsai

Would you rather raise a seed round or a Series A right now? That’s a question that TechCrunch’s Harri Weber recently posed to me at Disrupt 2022. Questions like that loom large for many founders these days. My message to them: even in difficult times we see opportunities to build game-changing businesses.

At Disrupt I had a chance to connect with founders and share 500 Global’s outlook. As a global investor, we’ve watched crises come and go and those challenges have never dimmed our belief in startups all around the world. That’s why 500 Global has invested in more than 2,700 companies since 2010. Back then the term “pre-seed” didn’t even exist, but the opportunity to write the first checks for talented entrepreneurs did—just like it still does today.

Market turmoil typically sees people pull back and become more risk averse, but we’ve always perceived that such times can be a great moment to launch a startup. We don’t think early stage companies are immune from a broader market pullback, but we believe the impact is less for seed and pre-seed startups. Already, it’s exciting to watch what’s being built right now compared to frothier times.

When it comes to fundraising during this uncertainty, I believe it’s critical for early stage founders to build a pipeline of seasoned investors who focus on seed and pre-seed stages. Considering an accelerator program can offer really strong benefits as well: alongside access to mentorship, founders are able to connect with other founders going through the same challenges. When it comes to choosing a program, talking to other founders that have completed the program can be helpful to see if it’s a good fit.

Is joining an accelerator a good option for startups that have already raised funding? I have seen plenty of our founders raise money before taking part in one of our programs where nobody bats an eye. Some founders may be concerned that joining an accelerator will be a tough sell to existing investors if the program comes in at different terms, but there can be ways to navigate that scenario.

Launching a startup today may not be easy, but I see plenty of founders solving hard problems around AI and machine learning, sustainability, climate tech, health and beyond. Crucially, founders in emerging markets are building companies we find to be very exciting. Some on Sand Hill Road might see emerging markets as higher risk now. But our model is built around investing globally, which is why we plan to continue pressing forward across different markets, such as Central Eastern Europe, Pakistan, Africa, Southeast Asia, and more.

As we continue investing in startups around the world, and our portfolio continues to grow and mature, we’re also focused on expanding our scope. 500 Global’s bread and butter is backing early stage startups, but we’re now flexing our muscles to follow our founders through Series A and Series B rounds, all the way to pre-IPO, and evolving into a multi-stage venture firm with deep global roots. Looking ahead, I’m excited by our portfolio and the future. Great companies are going to continue to be founded, and there’s capital to be deployed.

If founders can focus on building companies that solve a real problem, while prioritizing solid fundamentals over growth at all costs, we believe investors are going to stay interested. There are always going to be things out of our control, but as venture capital investors we’re playing the long game.

THE CONTENT IN THIS POST IS PROVIDED FOR GENERAL INFORMATIONAL OR EDUCATIONAL PURPOSES ONLY. 500 GLOBAL MAKES NO REPRESENTATIONS AS TO THE ACCURACY OR INFORMATION CONTAINED HEREIN AND WHILE 500 GLOBAL HAS TAKEN REASONABLE STEPS TO ENSURE THAT THE INFORMATION CONTAINED HEREIN IS ACCURATE AND UP-TO-DATE, NO LIABILITY CAN BE ACCEPTED FOR ANY ERROR OR OMISSIONS. UNLESS OTHERWISE STATED IN THIS POST, ANY PREDICTIONS, FORECASTS, CONCLUSIONS, VIEWS OR OPINIONS EXPRESSED REPRESENT THE CURRENT VIEW AND THINKING OF 500 GLOBAL WITH REGARD TO THE SUBJECT MATTER THEREIN BASED ON INTERNAL DATA AGGREGATED ACROSS ALL 500 GLOBAL FUNDS AS OF 11/10/22 AND/OR ANALYSIS WHICH HAS NOT BEEN INDEPENDENTLY VERIFIED, AND WHICH IS SUBJECT TO CHANGE AT ANY TIME. UNDER NO CIRCUMSTANCES SHOULD ANY OF THE ABOVE CONTENT BE CONSTRUED AS LEGAL, TAX OR INVESTMENT ADVICE FROM 500 GLOBAL OR ANY OF ITS AFFILIATES. 500 GLOBAL DOES NOT GUARANTEE ANY FUTURE RESULTS FOR ANY DECISIONS MADE BASED IN WHOLE OR IN PART ON THE CONTENT OR INFORMATION CONTAINED HEREIN. ALL READERS OF THIS POST SHOULD CONSULT WITH THEIR OWN COUNSEL, ACCOUNTANT OR OTHER PROFESSIONAL ADVISORS BEFORE TAKING ANY ACTION IN CONNECTION WITH THIS POST. UNDER NO CIRCUMSTANCES SHOULD ANY INFORMATION OR CONTENT IN THIS POST, BE CONSIDERED AS AN OFFER TO SELL OR SOLICITATION OF INTEREST TO PURCHASE ANY SECURITIES ADVISED BY 500 GLOBAL OR ANY OF ITS AFFILIATES OR REPRESENTATIVES. FURTHER, NO CONTENT OR INFORMATION CONTAINED IN THIS POST IS OR IS INTENDED AS AN OFFER TO PROVIDE ANY INVESTMENT ADVISORY SERVICE OR FINANCIAL ADVICE BY 500 GLOBAL. UNDER NO CIRCUMSTANCES SHOULD ANYTHING HEREIN BE CONSTRUED AS FUND MARKETING MATERIALS BY PROSPECTIVE INVESTORS CONSIDERING AN INVESTMENT INTO ANY 500 GLOBAL INVESTMENT FUND. UNDER NO CIRCUMSTANCES SHOULD ANY CONTENT BE INTERPRETED AS TESTIMONIALS OR ENDORSEMENT OF THE INVESTMENT PERFORMANCE OF ANY 500 GLOBAL FUND BY A PROSPECTIVE INVESTOR CONSIDERING AN INVESTMENT INTO ANY 500 GLOBAL FUND.