Reflecting on the company’s history and humble beginnings, here are my personal insights on the Southeast Asian tech giant, and how it differs from U.S. comparisons.

2021.11.30

500 Global Team

Source: Grab

In what will be the largest SPAC listing to date, Singapore-based Grab, a 500 Global portfolio company, will list on Nasdaq via a merger with Altimeter Growth Corp., a special purpose acquisition company. According to public filings, Grab is poised to raise around US$4.5 billion, valuing the company at nearly US$40 billion upon closing in early December 2021.

Founders Anthony and Hooi Ling Tan have come a long way since founding Grab nearly 10 years ago. I met them in 2012 when they returned to Kuala Lumpur after earning their MBA from Harvard, and I was running my media company. I helped Grab recruit its first technical hire, Suthen, and introduced the company to Vertex, which became its first institutional investor. When I became a VC with 500 Global in 2014, we had the privilege of becoming an investor. We spent a lot of time working with them to figure out mobile customer acquisition and growth hacking.

Picture taken at a Growth Hacking workshop I conducted for Grab’s marketing team in 2014.

But how exactly did Grab become a superapp, and what is its growth strategy? Reflecting on the company’s history and humble beginnings, here are my personal insights on the Southeast Asian tech giant, and how it differs from U.S. comparisons.

Grab milestones since its founding in 2012.

Source: Grab (Slide 10)

Grab is NOT the ‘Uber of Southeast Asia’

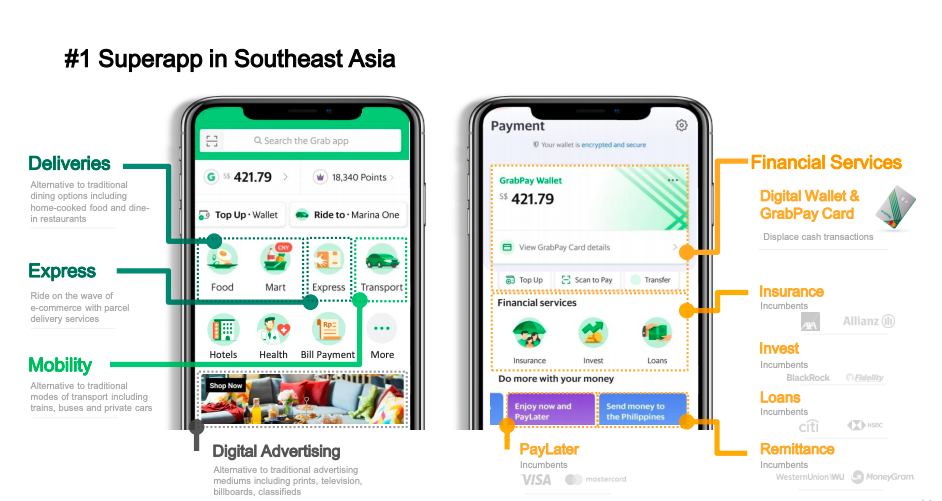

Think of it as Uber + DoorDash + PayPal, but with integrated UX. Uber’s original rideshare business alone is limited compared to the varied services Grab offers. In fact, Uber used to compete with Grab until Grab acquired its assets in Southeast Asia in 2018. Grab follows more closely to the original ‘superapp’ in China, Tencent, where consumers can get multiple on-demand products and services, integrated seamlessly with digital payments and an e-wallet.

So what does being a regional superapp mean? It means you have one app that serves multiple needs. The Southeast Asia region has a variety of superapps. Some are more dependent on one market, say Indonesia, while others like Foodpanda are focused on only one service category. Here’s a look at Grab’s superapp synergies at work in the chart below, which shows a strong correlation between the increase in user retention and the use of more services.

Source: Grab (Slide 25)

Grab is one of the foremost superapps, which competitively increases its scope in operating markets and service categories, and dimensions. The company claims to be number one in mobility as well as delivery in all six of its core markets. While some may see Grab’s closest peer to be Sea Group, we believe it is different. Sea Group derives most of its revenue in non-Grab segments, like e-commerce and gaming. Grab’s foothold in ride hailing, delivery, and fintech however, is seen as just the beginning.

Grab investors to date, excluding PIPE investors Grab announced in April 2021, such as BlackRock, Morgan Stanley Investment Management, and Fidelity International. VC funds that invested in Grab include 500 Global and GGV Capital. Source: Grab (Slide 32), with specific addition of 500 Global.

How did they do this?

Let’s trace the company’s first attack vector, the wedges it made along the way to where it is now, to understand its trajectory.

Grab began charting its own distinct superapp path by prioritizing solving trust and safety–big accelerants to transactions in ASEAN’s rapidly urbanizing market of over 650 million people.

From there, it accumulated a vast, on-demand network that would prove its incredible value in densely urbanized regions with low car ownership and limited public transportation options.

Grab then used this large base of drivers to catapult into deliveries, which grew in popularity because of Covid-induced lockdowns as people discovered the convenience of delicious meals brought to their door. Drivers now provide rides and are also available for deliveries, at no additional cost to Grab. Grab is a prime example of the sharing economy. Across its whole ecosystem, Grab shares resources with the aim of offering better services faster and cheaper to its network of users, drivers, and merchants.

We believe that the company’s execution-orientation and hyperlocal approach is its secret weapon. The founders have sunk tremendous energy, focus and commitment in the region since day 1. Anthony and I moved our families to Indonesia around the same time. He was operating Grab, and I was investing in Indonesian startups. I saw first hand how his founder fire stoked the ‘all-in’ commitment to be hyperlocal. He was always on-ground, engaging the ecosystem to grow as one.

Grab founder Anthony Tan (left), 500 Global managing partner Khailee Ng, and Quek Siu Rui (right), co-founder & CEO of 500 Global portfolio company Carousell. Photo courtesy of Khailee Ng

Grab built deeply local leadership teams who not only bring a deep understanding of each market, but also the right connections. Compounding that over the years, we believe this approach has paid off. Grab has reported three straight quarters of record gross merchandise value (GMV) growth (Q1, Q2, Q3 2021). GMV is one important lead metric because it is a signal of how much of a nation’s overall economy is flowing through the app.

Being one app to do it all as a leading value proposition is especially relevant to Southeast Asia because of the massive penetration of low-end smartphones. Now that Grab is a leader in this space, it is bolting on more and more services. Let’s explore these in detail.

Grocery.

Grab’s existing business claims a US$180 billion total addressable market within reach. This is already massive. But let’s look at one of the many categories it’s been pushing hard into. Grab estimates the addressable market for grocery delivery could reach $28 billion in GMV by 2025. With its growing dominance in meal delivery, Grab’s superapp model could help it quickly capture this opportunity in grocery delivery, with a large existing user base and its fleet of drivers already making deliveries. In the markets Grab competes in, grocery delivery is seen to have the potential to be far larger than food delivery over time.

Fintech.

Its app now offers financial products that folks in mature markets take for granted: digital loans, investments and even insurance. Grab uses its high-trust brand to bring these fintech services to many consumers for the first time. Unlike other fintech-only players, Grab’s moats are its many high-volume transaction categories.

Digital financial services are an even bigger opportunity. Singapore, for example, has never had a fully digital bank before, and the country’s regulator has awarded Grab (along with Sea Group) a highly coveted licence to do so in 2022. Aside from digital loans and insurance, Grab launched retail wealth management in Singapore last year.

Fintech alone is a huge business. Some may remember the story of eBay and Paypal. PayPal was invented to facilitate paying “by email” for eBay transactions. Within a few years, PayPal grew exponentially, and today, it’s an independent, publicly traded company many times larger than its parent.

World Class ESG leadership in Southeast Asia

Grab had roots in Malaysia as a social enterprise, with one of its founding visions being improvement of the safety of taxi passengers. This DNA continues in its ongoing commitment to ESG–perhaps surprising given Southeast Asia’s gap in ESG leadership when compared to developed markets on such metrics.

Grab produced its first ESG report earlier this year, which includes detailing its Corporate Social Responsibility efforts with its GrabForGood Fund. Grab championing ESG helps VCs make the case to their portfolio companies. It’s a huge signal for other fast growing startups to get ahead of ESG, broadly in line with 500 Global’s ESG initiatives and aspirations. We’re really happy to see Grab take the lead here.

With its international shareholder register, Grab is increasingly being viewed through the lens of American expectations of governance and transparency. We believe that a strong ESG infrastructure cements foundations for a sustainable future not just for Grab, but all the partners and communities it serves.

Southeast Asia’s Tech Giants Have Arrived

Grab’s listing day will be a first for Southeast Asia to showcase its dynamic market, through the eyes of arguably one of the most well-known and integrated services in the lives of its people. What matters more is the road ahead: how the Southeast Asia founders and management team members that 500 Global had the pleasure of working with through the years steward its capital to serve the ambitions of 650 million people.

Moving towards the successes that the U.S. has seen with FAANG or China with BAT, Southeast Asia is now rolling on a similar path with Grab. From the company’s humble beginnings, unicorn DNA and now its role as a globally recognized tech giant, Grab reminds investors like us of what’s possible – and we’re excited to see all that they will do and achieve for Southeast Asia.

The views expressed here are those of the individual 500 Global personnel, or other individuals quoted and are not the views of 500 Global or its affiliates. Certain information contained herein may have been obtained from third-party sources, including from portfolio companies of funds managed by 500 Startups Management Company, L.L.C.. While taken from sources believed to be reliable, 500 Global has not independently verified such information and makes no representations or warranties as to the accuracy of the information in this post or its appropriateness for a given situation. In addition, this content may include third-party advertisements or links; 500 Global has not reviewed such advertisements and does not endorse any advertising content contained therein. This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, tax or accounting advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation, offer to sell or solicitation to purchase any investment securities, or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by 500 Startups Management Company, L.L.C. (an offering to invest in a 500 Startups Management Company, L.L.C. fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety), or any investments or portfolio companies mentioned, referred to or described herein. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by 500 Startups Management Company, L.L.C, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. Charts and graphs provided herein are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Unless otherwise expressly stated, figures are based on internal estimates and have not been independently verified. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. All logos and trademarks of third parties referenced herein are the logos and trademarks of their respective owners and any inclusion of such trademarks or logos does not imply or constitute any approval, endorsement or sponsorship of 500 Global by such owners. Please see Section 2 of our Terms of Use for additional important information.